The notorious stockbroker Jordan Belfort, whose life inspired Martin Scorsese’s movie “The Wolf of Wall Street,” believes that at the present, investors should only deal with bitcoin (BTC) and ether (ETH).

He advised against investing a large portion of one’s money in cryptocurrencies owing to the market’s volatility and hazards.

Don’t Disregard Keys While Money Management from Bitcoin

People who are really interested in learning more about cryptocurrencies are fully aware of the significance and function of the exchange. Without the availability of a recognized exchange that offers high-quality services, it is impossible to transfer digital currency for the overall experience.

The ability to use the money is crucial to achieving the aim, and the continued viability of the currency depends on the exchange’s silent actions. Amazingly, serious exchange addresses include a few of the qualities that must be present as well as a few in the exchange platform. Therefore, you should think about learning about Bitcoin and Financial Technology if you are interested in Bitcoin trading.

On the reputable platform, there is a good distribution of services, including the availability of information and regular updates regarding the current volatility. The trading platform is likewise subject to the rules requiring notification of distribution and recommendations on essential components.

The main player will always understand how things function and the nature of the unit exchange that runs the company. Act intelligently rather than following the mob like a clueless chicken with no sense of direction.

The best way to become familiar with the exchange policies is to follow the advice, but wait to take any action until you are confident in your choice. But the exchange’s focal point for expert experience needs to have the following qualities.

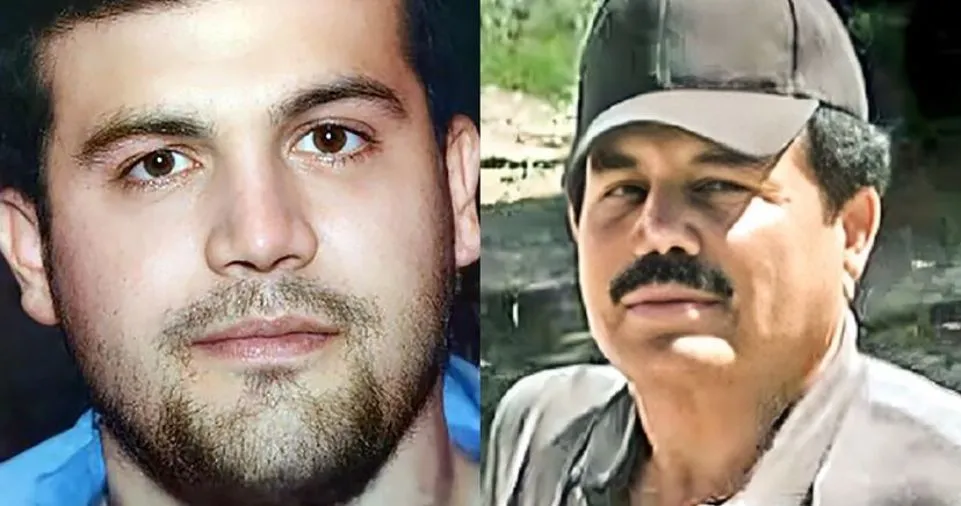

Belfort’s U-turn on BTC

The most recent suggestion reflects a shift in Belfort’s viewpoint on the most important cryptocurrency. He claimed that BTC was “based on the Great Fools Theory” in 2018, which holds that prices rise as a result of consumers selling overpriced goods to “bigger fools.”

But Belfort appears to have changed his mind about his position four years later.

After losing 45% in June, Bitcoin (BTC) and the rest of the cryptocurrency market are currently in a slump, experiencing their worst monthly closing in 11 years. The bellwether digital asset fell below $18,000 in the same month, hitting its lowest point since 2017.

A former trader named Belfort was convicted of securities fraud and money laundering. He received a four-year prison term.