At a time when many people were declaring the asset “dead,” PlanB bought three bitcoins.

PlanB, the developer of the Stock-to-Flow (S2F) model for bitcoin, acknowledged that he had made his third BTC investment. The main coin was trading approximately $20,000 at the time of purchase.

Due to bitcoin’s sharp price decline from its record high of $69,000 in November 2021, many have declared it extinct in recent months. PlanB, however, disclosed that he made each of his cryptocurrency investments when gloom was in the air.

PlanB Increases Exposure to BTC

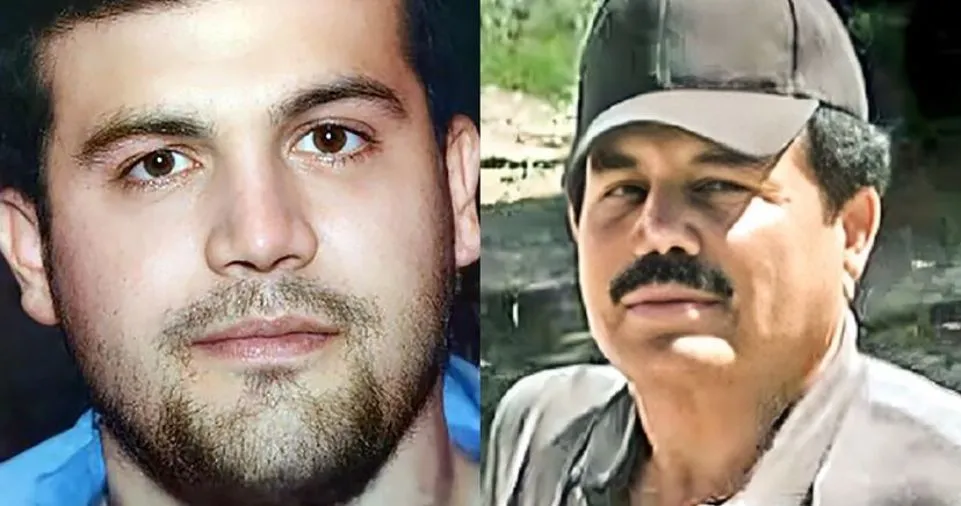

The timeline of PlanB, an anonymous Twitter user who goes by the alias PlanB, detailed his bitcoin purchases over time in a recent post.

In 2015, when the dominant digital asset was trading at around $400, he first entered the ecosystem. When BTC was at $4,000 three years later, he bought more. Recently, at a time when the currency was worth $20,000, he made his third investment.

It’s interesting to observe that every time PlanB made a purchase, the amount of Google searches for “Bitcoin is dead” was extremely high.

In times of a market crash, the aforementioned story becomes quite well-liked. When bitcoin fell to $17,500 in June of this year, the phrase reached an all-time high (an 18-month low).

It is important to remember that during its existence, the asset has been declared “dead” more than 450 times. It has always been able to overcome the problems and is now an asset with a market valuation of over $360 billion, despite its prior price falls, the critical tone from notable people, and the disastrous economic environment.

Even though this figure is not as remarkable as it was in November 2021, when Bitcoin’s projected worth was over $1 trillion, it is still higher than the market capitalization of well-known companies as Meta (previously Facebook), Walmart, Nestle, and more.

PlanB’s STF Model and a Potentially Hopeful Future for BTC

Most notably, the analyst known by the Twitter handle PlanB created the bitcoin stock-to-flow model (S2F). Based on bitcoin’s circulating supply and the annual amount of coins mined, it offers a possible future USD valuation for the digital currency.

It would greatly surprise me if bitcoin will have a lower market value than gold after the next halving when BTC S2F 100+, according to PlanB, who predicted that the cryptocurrency will hit $100,000 by the end of 2023.

It is important to note that PlanB’s predictions have not always been accurate. He stated in April of this year that BTC is unlikely to ever go below $24,500 and that it may reach the $100K mark in 2022.

However, in reality, the asset has been circling around $20,000 for the past few months, and it appears improbable that it will reach the desired price before the year is over.